net operating working capital turnover

Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and days sales in inventory indicate liquidity problems. 4 lakh the turnover ratio is 5 ie.

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

The formula consists of two components net sales and average working capital.

. A working capital turnover ratio is generally considered high when it is greater than the turnover ratios of similar companies in the same industry. Operating working capital is a narrower measure than net working capital. What is Working Capital Turnover Ratio.

WORKING CAPITAL TURNOVER RATIO The working capital turnover ratio is also known as net sales to working capital. Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. For example if three of your close competitors have working capital turnover ratios of 55 42 and 5 your ratio of 7 is high because it exceeds theirs.

The working capital turnover is a ratio to quantify the proportion of net sales to working capital. The working capital turnover is a ratio to quantify the proportion of net sales to working capital. 20 lakh and average working capital Rs.

It measures how efficiently a business turns its working capital into increase sales. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. Working capital is a companys total assets less total liabilities.

The Working Capital Turnover Ratio is also called Net Sales to Working Capital. Its purpose is to indicate the companys effectiveness in using its working capital. The Working Capital Turnover Ratio indicates how effective a company is at using its working capital.

Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating liabilities. In this formula working capital refers to the operating capital that a company uses in day-to-day operations. Net sales of 2400000 divided by average working capital of 400000 6 times during the year.

The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as. This liquidity ratio demonstrates how able a company is to pay off its current operational liabilities with its current operational assets. Net sales Beginning working capital Ending working capital 2 Example of the Working Capital Turnover Ratio.

The calculation of its working capital turnover ratio is. This ratio demonstrates a companys ability to use its working capital to generate income. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this.

When a business is able to generate sales collect the funds produce goods and services generate new sales and so on it needs to have a good handle on its cash management working capital and. Working capital turnover ratio is a formula that calculates how efficiently a company uses working capital to generate sales. Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and.

The ratio is very useful in understanding the health of a. Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. There is a regular flow of money which gives the business the flexibility to.

This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current. As with most financial ratios you should compare the working capital turnover ratio to other companies in the same industry and to the same companys past and planned working capital turnover ratios.

In other words it displays the relationship between the funds used to finance the companys operations and the revenues the company generates as a result. Also known as net sales to working capital working capital. Working Capital Turnover Ratio helps in determining that how efficiently the company is using its working capital current assets current liabilities in the business and is calculated by diving the net sales of the company during the period with the average working capital during the same period.

Working capital turnover is a ratio that measures how efficiently a company is using its working capital to support sales and growth. The higher the working capital the more smoothly the business runs as it had additional funds. Working capital turnover sales working capital 2.

Net operating working capital turnover. Working Capital Turnover Ratio is a financial ratio which shows how efficiently a company is utilizing its working capital to generate revenue. Working capital turnover ratio is the ratio between the net revenue or turnover of a business and its working capital.

For instance if a businesss annual turnover is Rs. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. Working capital turnover is a ratio that quantifies the proportion of net sales to working capital and it measures how efficiently a business turns its working capital into increased sales numbers.

Since net sales cannot be negative the turnover ratio can turn negative when a. Working capital turnover ratio is computed by dividing the net sales by average working capital. To understand working capital turnover we must first understand the meaning of working capital.

This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return. 60 Working capital turnover ratio. The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital.

It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time. Therefore its working capital turnover ratio was. Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million.

Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses.

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

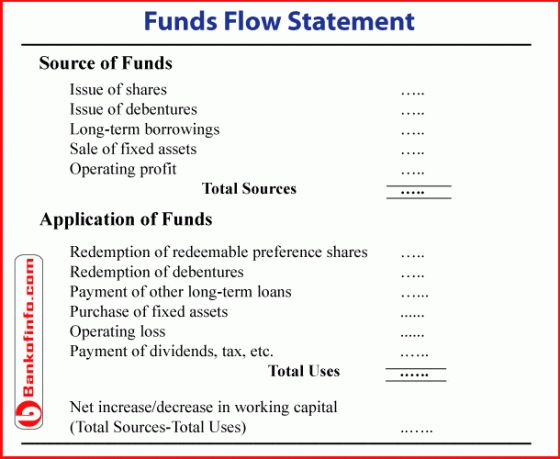

How To Prepare Fund Flow Statement Fund Cash Funds Flow

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Cost Accounting Accounting

Common Financial Accounting Ratios Formulas Financial Accounting Financial Analysis Financial Statement

One App Bookkeeping Business Small Business Finance Business Finance

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work

Http Image Slidesharecdn Com Kpis 150429010959 Conversion Gate02 95 Key Performance I Key Performance Indicators Operations Management Accounting And Finance

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap Management Capital Finance It Network

Does Your Small Business Need A Cfo Nfib Small Business Accounting Cfo Small Business Finance

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

The Statement Of Cash Flows Is Unmistakably The Most Difficult Of The Financial Statements To Prepare With Three Sec Financial Accounting Accounting Cash Flow

Finance Basics Managing Finances And Tax Operating A Business Business Victoria Small Business Finance Business Funding Small Business Funding

Top 4 Important Financial Modeling Techniques Simple Educba Financial Modeling Financial Analysis Modeling Techniques

Bookkeeping 101 Financial Ratios The 8 Ratios You Need To Know Financial Ratio Financial Analysis Financial Management

Accounting Ratios Financial Ratios Are Calculated Within A Firms Financial Statement To See How Profitable It I Financial Ratio Accounting Financial Analysis

P L Is Positive But Your Cash Flow Isn T In 2021 Cash Flow Positive Cash Flow Balance Sheet

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

4 Best Financial Ratio Analysis Technique Discussed Briefly Financial Ratio Trade Finance Finance Investing

P L Is Positive But Your Cash Flow Isn T In 2021 Cash Flow Positive Cash Flow Balance Sheet